Employment Allowance

This limit was originally 2000 a year when it was introduced in the 2013-2014 tax year but was increased to 3000 from the 2015-2016 tax year. This section explains how your circumstances will determine which type you might get.

Employment Allowance Access Restricted To Smaller Employers Employee Benefits

However there are exceptions and some kinds of permitted work that are allowed.

. Employment and Support Allowance ESA money if you cannot work because of illness or disability - rates eligibility apply assessment. It is currently being phased out and replaced with Universal Credit for claimants on low. If your company is eligible for Employment Allowance you can reduce your employer Class 1 national insurance NI contributions by up to 4000 per year.

Employment and Support Allowance ESA is a United Kingdom welfare payment for adults younger than the State Pension age who are having difficulty finding work because of their long-term medical condition or a disabilityIt is a basic income-replacement benefit paid in lieu of wages. This means that youll pay less employers Class 1 National. What is the Employment Allowance.

It increased from 3000 to 4000 in 2020 after successful lobbying by FSB. Have worked as an employee or been self. There are three different and distinct types of Employment and Support Allowance.

The general rule is that you cant work while claiming Employment and Support Allowance ESA or the incapacity benefits ESA replaces. The Employment Allowance lets eligible employers reduce their National Insurance liability by up to 4000 for the 202122 tax yearIts designed to support smaller employers with their employment costs. To meet the eligibility criteria for the new style Employment and Support Allowance you will need to all.

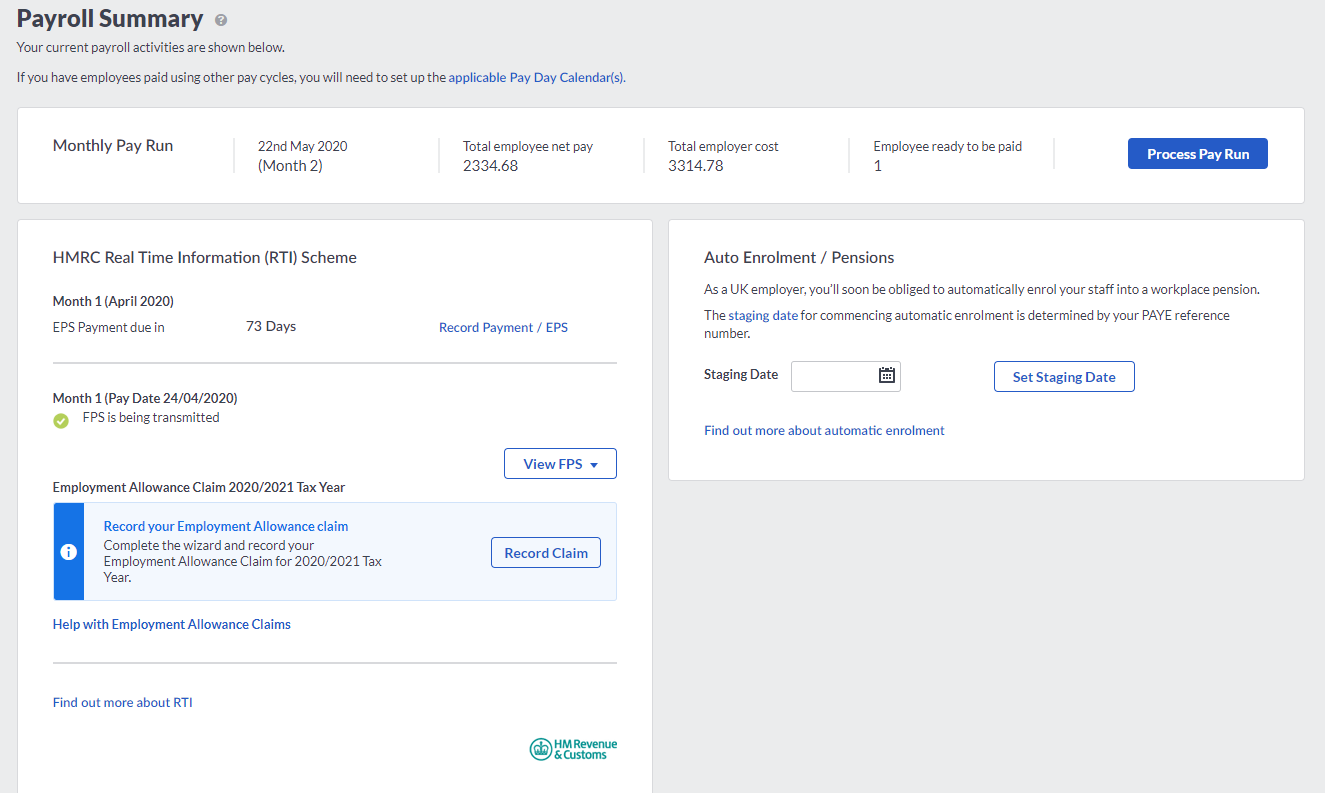

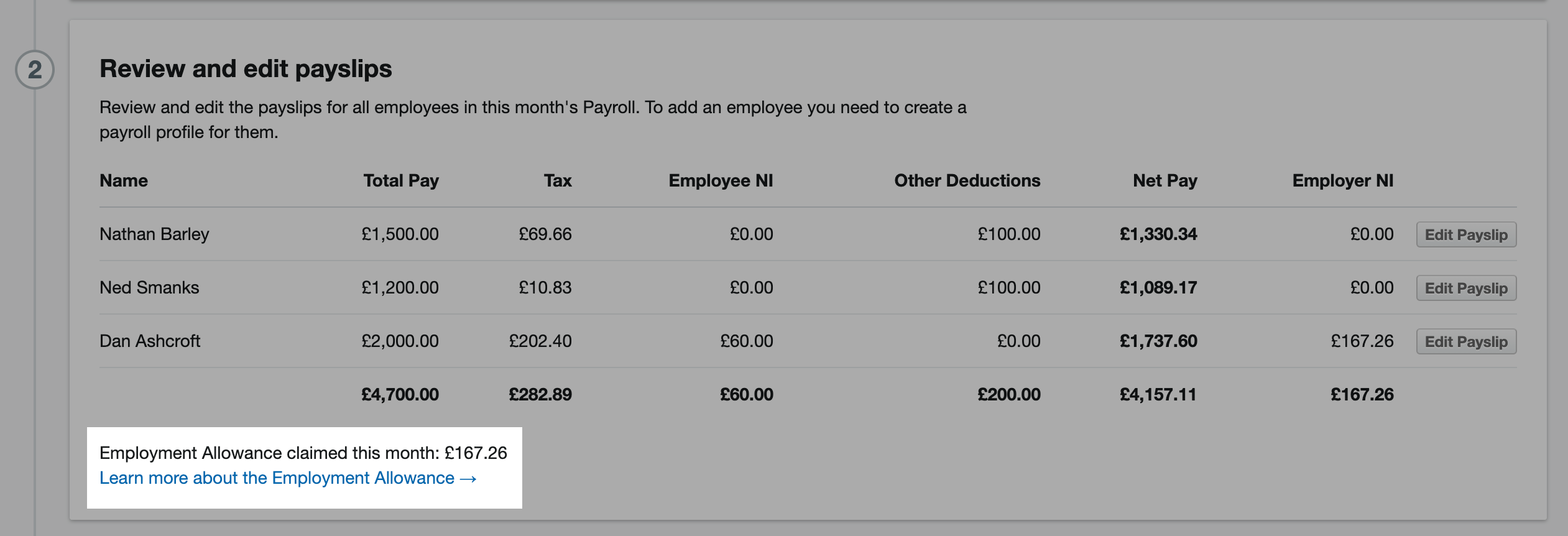

The Employment Allowance Freeagent

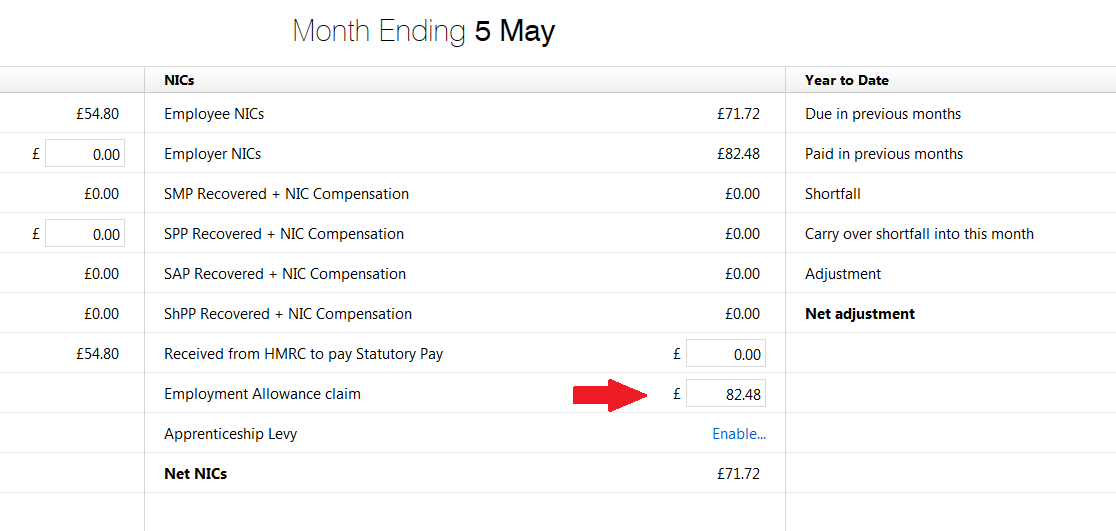

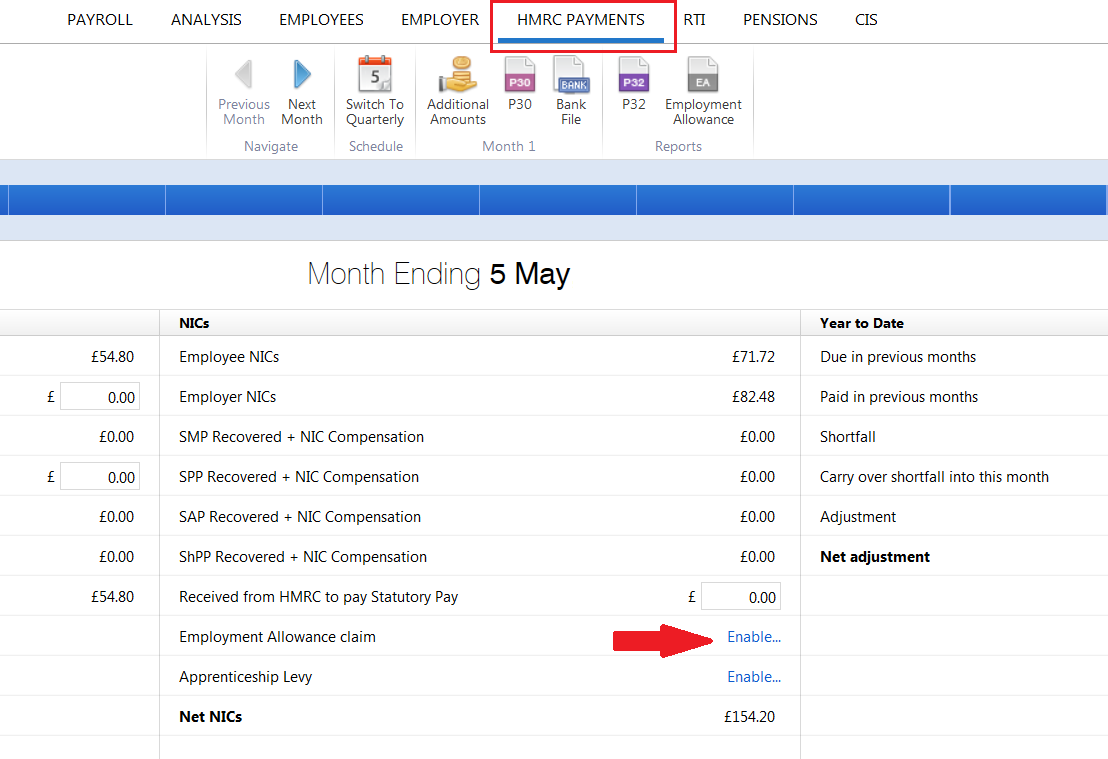

Nics Employment Allowance Nics Employment Allowance Flickr

Employment Allowance Business Sector Choice Errors Payadvice Uk

![]()

How The Employment Allowance Could Save Your Business 4 000 A Year Freeagent

Employment Allowance Is Your Limited Company Eligible To Claim It Contracting

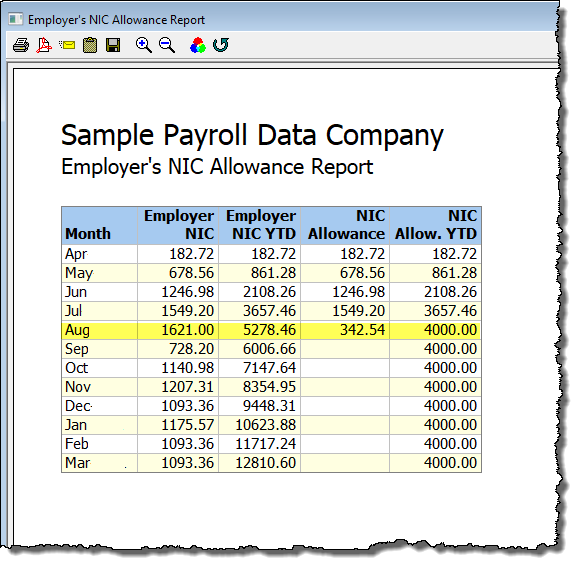

Employment Allowance Brightpay Documentation

Comments

Post a Comment